Credit Life insurance is typically mandatory to granting loans. The borrower should be informed about the insurance protection, so that he is aware of the insurance cover.

Premiums may be loaded into the credit, or alternatively, insurance costs can be factored into the interest charged over the term of the loan.

Enhanced Credit Life protection is advisable, especially for total and permanent disability (TPD) payable in case of an accident.

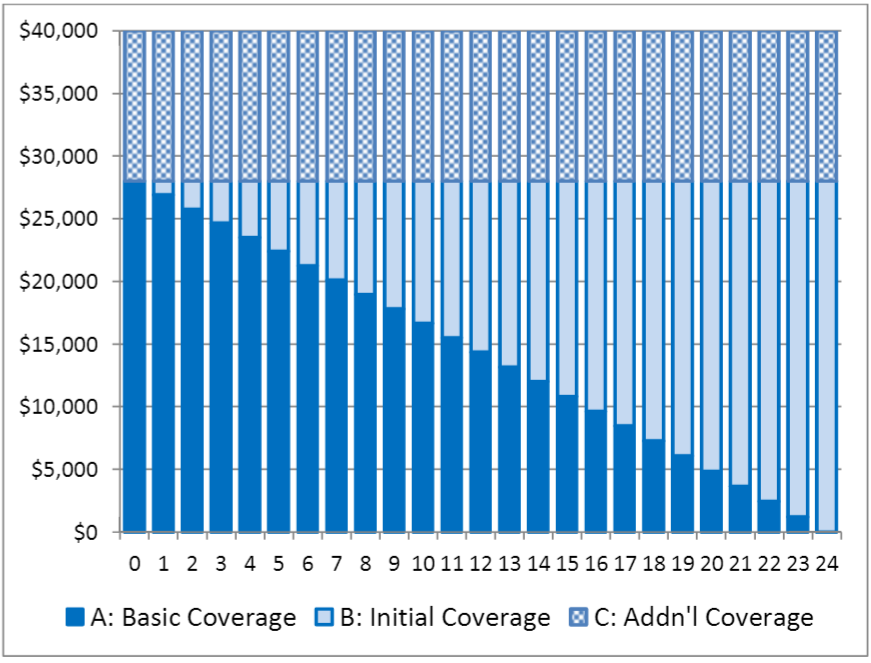

In the basic Credit Life product the outstanding loan is covered. An improved product covers the amount of the initial loan during the duration of the loan. To further improve the protection, an additional fixed amount of Life insurance may be added, either to the basic or to the enhanced product.

More comprehensive protection may include health covers and funeral expenses for the borrower and his family. Premiums are typically added to the amount of credit.

A: sum assured equals outstanding credit. (Beneficiary: the Lending Institution)

B: sum assured remains equal to initial amount of credit. (Beneficiaries: the Lending Institution and the legal or named beneficiary)

C: sum assured provides protection of the credit and additional protection to borrower’s family. (Beneficiaries: the Lending Institution and the legal or named beneficiary)